salt tax deduction news

But on Friday afternoon Democrats delayed a vote on the bill amid. News News Based on facts either observed and verified directly by the reporter or reported and verified from knowledgeable sources.

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

However its been a controversial.

. On Tuesday Mr. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan in the House of Representatives. This deduction is a below-the-line tax deduction only available to.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The SALT deduction is a tax break for high-earning individuals who indulge the progressive big-spending plans of state and local officials in states including California. Unfortunately it doesnt look like you will be getting any more federal relief on your state and local income taxes otherwise known as SALT.

The state and local tax deduction known as SALT was capped at 10000 under President Donald Trumps tax reform bill in 2017 in a move that Democrats decried as an attack on blue states like New. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. December 12 2021 930 AM 4 min read Dec.

But some party progressives including New York Representative Alexandria Ocasio-Cortez of New York have called the SALT deduction a. The Supporting Americans with Lower Taxes SALT Act sponsored by US. The Tax Cuts and Jobs Act 2 however added Section 164b6 to the Code which imposes a 10000 annual limitation on an individual taxpayers deduction of certain taxes including state and local income taxes for taxable years beginning after December 31 2017 and before January 1 2026 the SALT limitation.

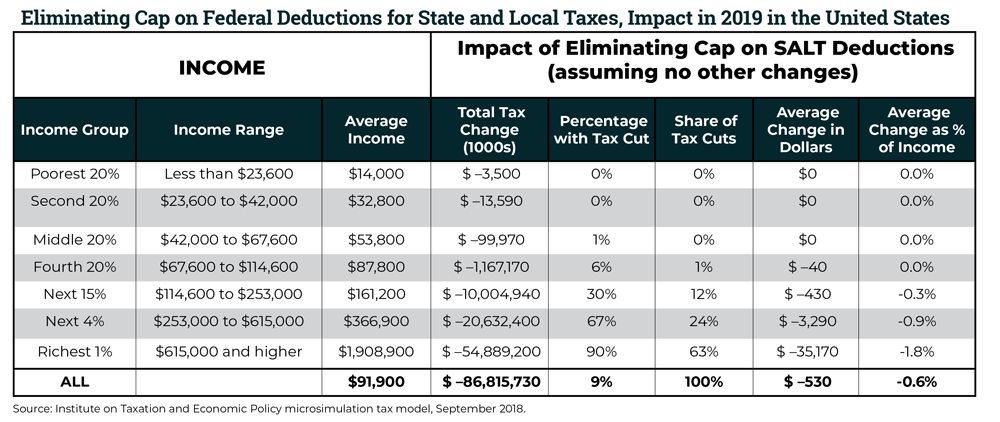

Approximately 125000 Erie County households experienced a tax increase because of the limit placed on the SALT deduction with the average increase reported at. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

Manchin told CNN that the Build Back Better bill is dead That should spell the end for the SALT deduction a benefit for high earners in high-tax states. Our new business reporter Daniel Munoz explains. Prior to the Republican.

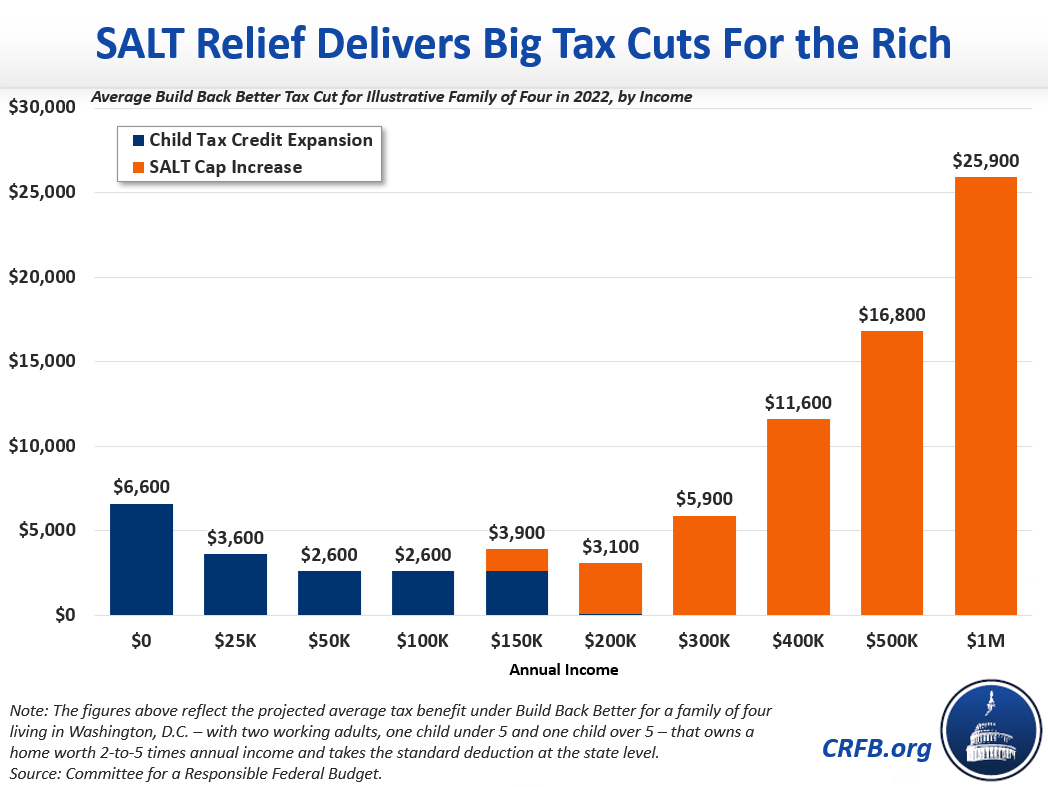

Bill Ackman BillAckman December 12 2021 The House expanded the SALT deduction to 80000 from 10000 in its version of the bill but Senate Democrats have said that would give the wealthy. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

Porter-backed bill seeks to restore SALT deductions capped under 2017 tax act Rep. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. After all partners or shareholders might otherwise have to reckon with the Sec.

Published January 4 2022 at 506 PM EST Mark Lennihan AP Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the. 52 rows Like the standard deduction the SALT deduction lowers your adjusted gross income AGI. Katie Porter D-Irvine co-sponsored the latest effort to roll back a provision of the Trump tax plan.

While the 10000 ceiling on the SALT deduction is set. Enacted by the Tax. All About SALT the Tax Deduction That Divides US.

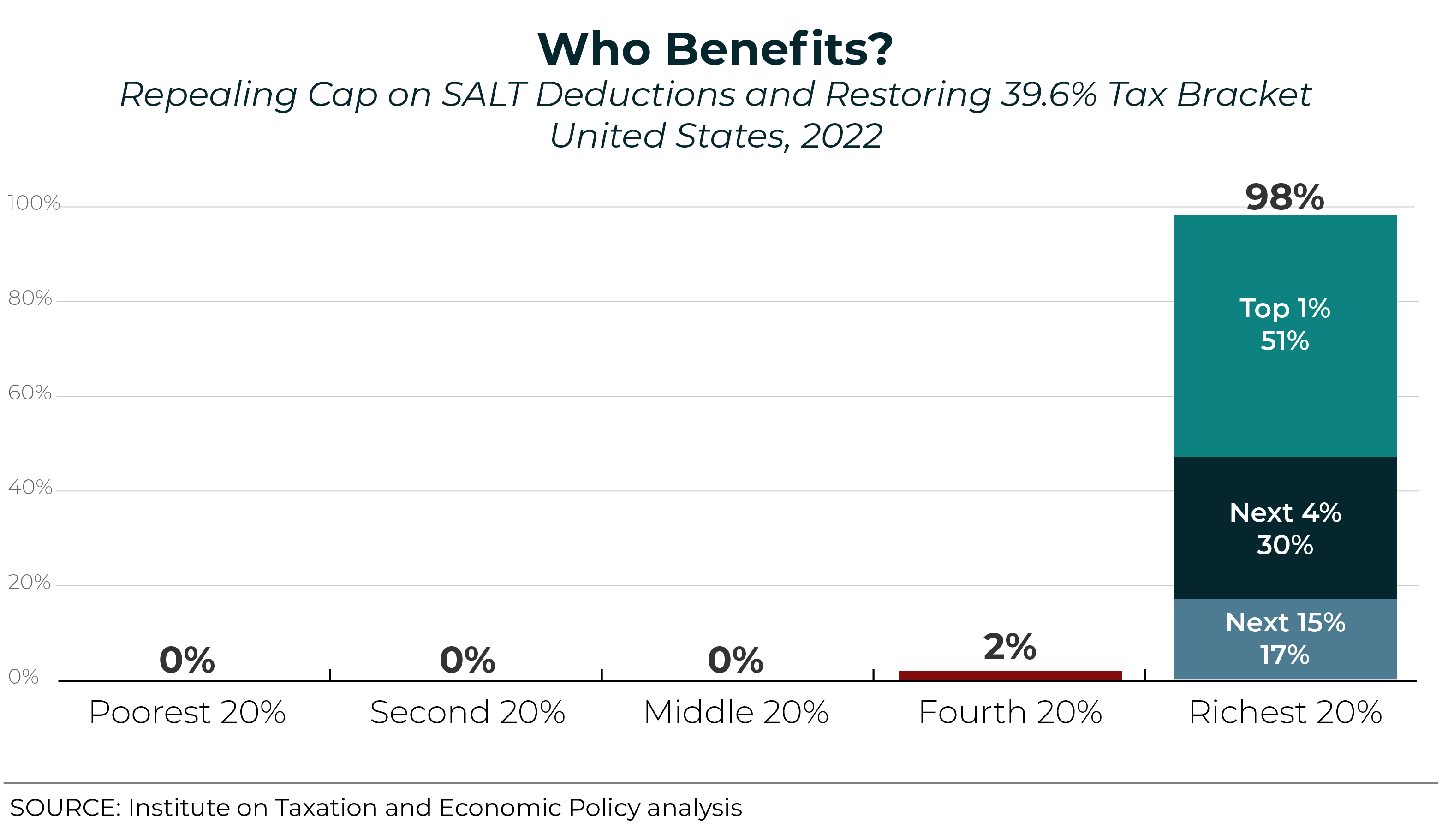

Bernie Sanders has said that raising SALT deductions amounted to a tax cut for the wealthy. Getty Images While Manchin has asserted the bill is dead in its current form he recently expressed. A new bill sponsored by a pair of Democrats in the House of Representatives seeks to repeal the 10000 cap on state and local tax deductions.

Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law - which reduced the corporate tax rate. And it is. The latest SALT deduction bill introduced by Representatives Tom Malinowski of New Jersey and Katie Porter of California would remove the current 10000 cap entirely for those making less than.

Notably in enacting.

The Impact Of Eliminating The State And Local Tax Deduction Report

Salt Tax Deduction 11 Million Taxpayers Taking A Hit From New Tax Law Deduction Tax Deductions Tax Refund

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Real Estate Investing News Advice Biggerpockets Blog Tax Help Estate Tax Income Tax

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Steve Rattner Breaks Down Impact Of Salt Deduction Cap Morning Joe Msnbc Youtube

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

What Is Salt Tax Deduction Mansion Global

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

Salt Tax Deduction What Is The Salt Deduction Limit Marca

Use Our Tax Calculators And Find Great Information About Taxes Estate Tax Property Tax Tax Deductions

2022 Changes To Popular Tax Deductions Cpa Practice Advisor

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist